On 30th October 2024, the Chancellor of the UK, Rachel Reeves announced a budget with over £40bn in tax rises (more than any budget in at least half a century).

Many will have already made plans to relocate in anticipation of these changes. Many others will be looking at their options.

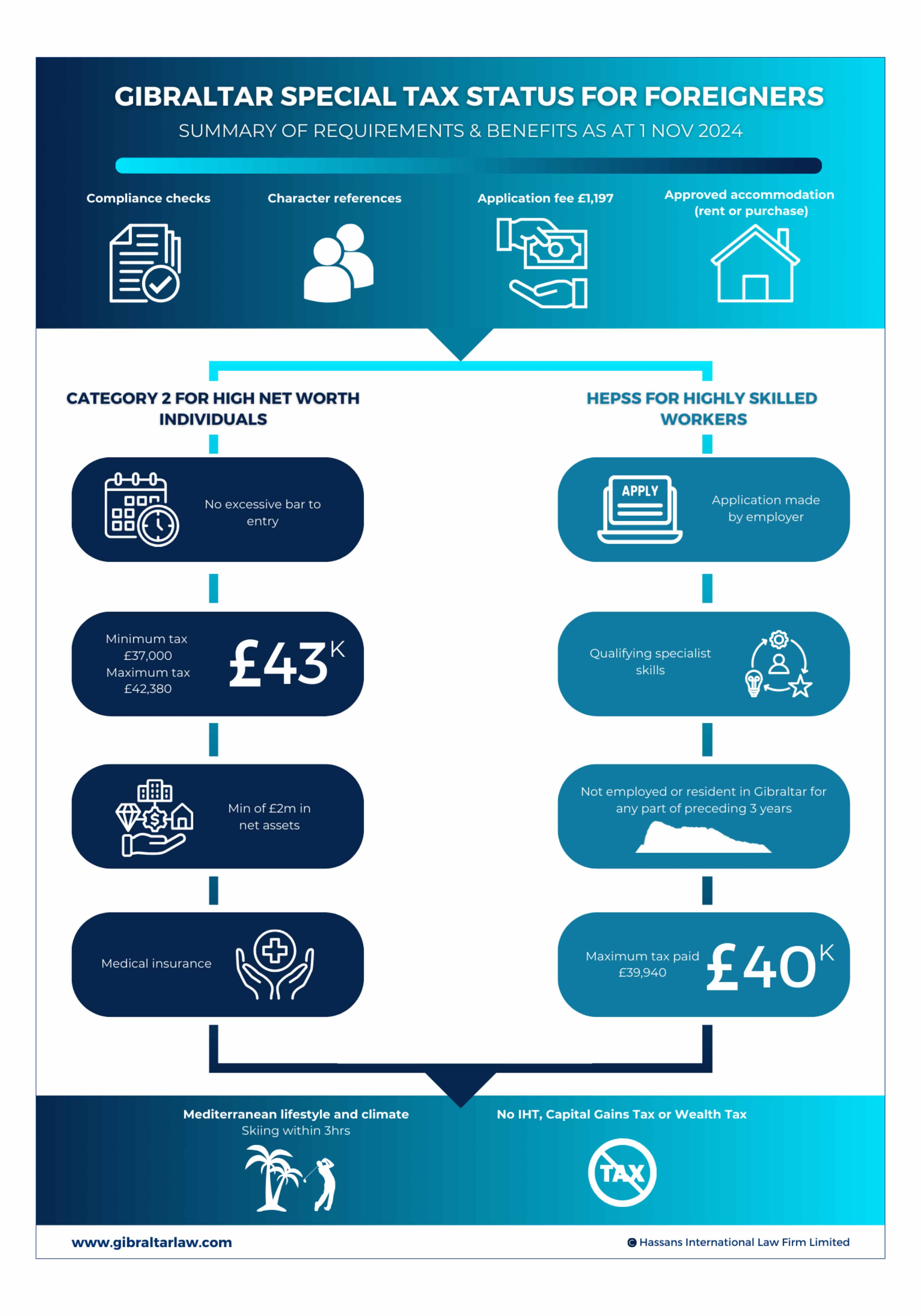

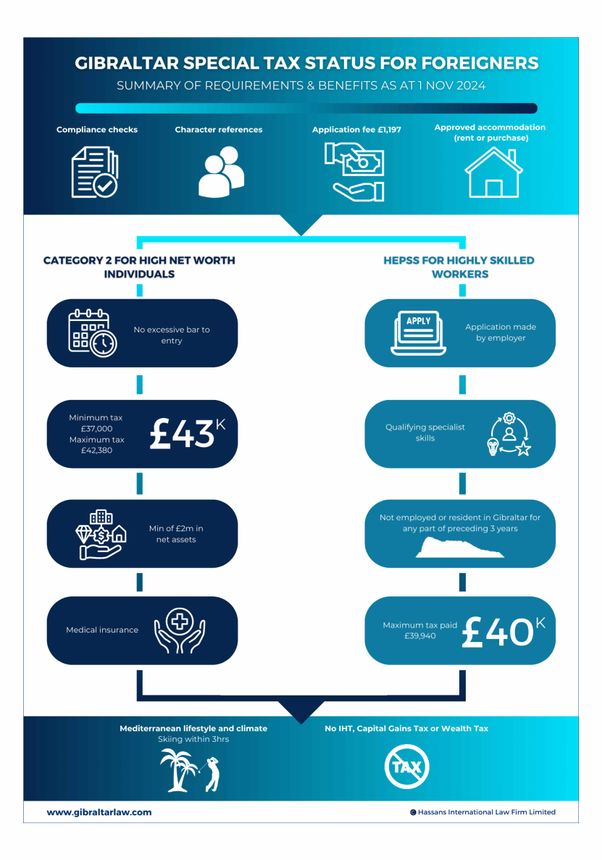

Yesterday we published a super snappy overview of the changes relevant to non-doms, and the key reasons for non-doms to consider Gibraltar as an alternative. Apart from becoming ordinarily resident in Gibraltar, there are 2 other attractive options available to foreigners:

- CAT 2 Status for High Net Worth Individuals

- HEPSS for Highly Skilled Workers

To help you understand the benefits and requirements of these options, we have prepared a simple infographic.

Please share with your networks and contact Grahame or me with any queries.

Download your hi res version here.

/Passle/5e2ef0738313d50b64779f79/MediaLibrary/Images/2026-02-12-11-57-03-138-698dc00fcb030dac6b901bca.png)

/Passle/5e2ef0738313d50b64779f79/MediaLibrary/Images/2026-01-19-10-37-07-336-696e0953d6061666adb5d863.png)

/Passle/5e2ef0738313d50b64779f79/MediaLibrary/Images/2026-02-19-15-39-22-788-69972eaaed31acc93b162f50.png)

/Passle/5e2ef0738313d50b64779f79/MediaLibrary/Images/2026-01-19-10-37-07-322-696e0953377579228cc69376.png)