January 21, 2021

The Solvency II directive led to a material increase in the capital that insurers were required to hold but also widened the forms of admissible capital beyond share capital.

ACTi (led by Darren Viñales) and Hassans (led by Nigel Feetham QC) have recently acted on the capitalisation of a Gibraltar insurer and its Gibraltar domiciled insurance holding company. The structure was designed by ACTi and Hassans and we believe it is the first of its kind in Gibraltar involving the allotment of shares callable on demand supported by a letter of credit issued by a leading financial institution.

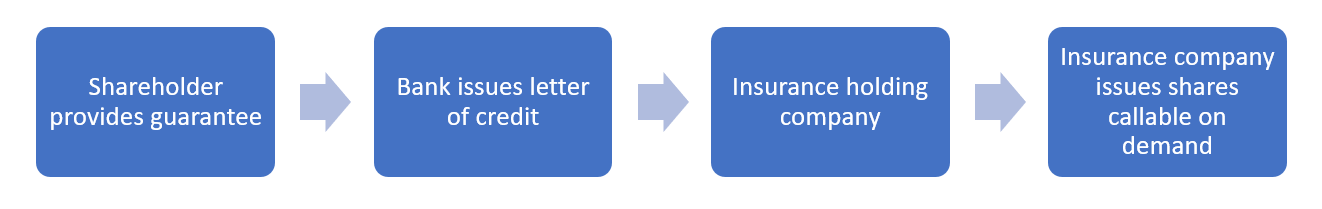

Without giving away the detailed structure for obvious reasons, the transaction looked like this:

Once approved by the supervisory authority (the Gibraltar Financial Services Commission) the structure leads to an immediate increase in Tier 2 ancillary own funds of both the insurance company and the insurance holding company. The eligibility criteria set out in the Solvency II rules allow insurers to meet up to half of the Solvency Capital Requirement using Tier 2 own funds including ancillary own funds.

The key criteria for obtaining supervisory approval for such a structure are that the funds are available and callable on demand, that there are no disincentives for making a call and that following a call the insurance undertaking will have paid up capital in place meeting all the criteria for classification as unrestricted Tier 1 (ordinary share capital).

The above structure has a number of advantages over other types of Tier 2 capital we have seen in Gibraltar, including subordinated liabilities, which has up to now been the method of choice for external capital for insurers without issuing shares. These advantages include flexibility over the term of the arrangement, as there is no minimum term for the capitalisation, and that no immediate funds are transferred.

In this case the structure benefited from the letter of credit provided by the bank which enjoys a credit rating and which satisfies the requirement for funds to be available on demand. ACTi and Hassans have significant experience in helping to design capital structures and would be well placed to assist clients in developing an ancillary own funds solution to meet their needs.

Darren Vinales (ACTI) said: “We worked on this transaction through the Christmas period and it was approved expeditiously by the Gibraltar regulator. Over the years I have worked with Nigel Feetham QC (Hassans) on numerous other transactions/matters and I am delighted we could help deliver this client solution.”

Nigel Feetham QC (Hassans) said: “We have done much structuring and capital raising work for the Gibraltar insurance market over many years. Alternative forms of tier capital are now increasingly becoming popular given the structuring options and flexibility. Darren has proved to be extremely knowledgeable on Solvency II and this makes client specific solutions that much easier”.

Postscript: Other transactions/structuring worked on by Nigel Feetham QC recently include:

- Subordinated loans in respect of tier 2 own funds.

- Tier 1 own funds.

- Mixed Activity classification.

- Application of “other supervisory measures” in group structures.

- M&As.

- New Licence Applications.

- Due Diligence Reviews.

/Passle/5e2ef0738313d50b64779f79/MediaLibrary/Images/2024-07-22-12-55-20-944-669e56b80e665f7cf84dcde1.jpg)

/Passle/5e2ef0738313d50b64779f79/SearchServiceImages/2024-07-24-15-12-06-904-66a119c605040ef8b40f6ea9.jpg)

/Passle/5e2ef0738313d50b64779f79/SearchServiceImages/2024-07-23-07-54-54-699-669f61ce137180fc028d141c.jpg)